From the blog...

CFIRP Directive 8.1.05 Lots and lot size

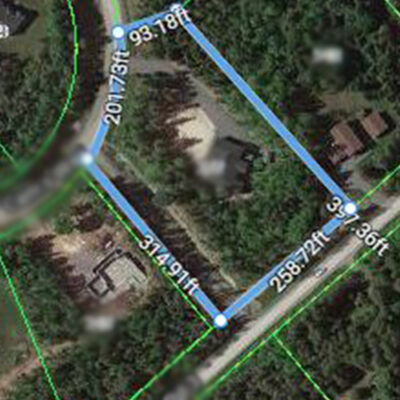

Ottawa has many rural areas that are of interest to our house-hunting military clients. Estate lots can provide privacy and space to spread out. It is important to note the directive on lot sizes if you are considering buying this type of property. Brookfield may not cover a portion of your land transfer tax if the house is over 1.25 acres.

Per CFIRP Directive 8.1.05 Lots and lot size,

The reimbursement of expenses is limited to a lot size of:

• 1.25 acres (½ hectare); or

• up to four acres (2.47 hectares) where required by zoning laws and city bylaws.

If additional land is sold or purchased, CF members are entitled to reimbursement only for that portion of costs which would have been reimbursed within the above limitations.

If there is a zoning bylaw for your area that requires this larger lot size in order to purchase in this area, then you can submit proof of this and resubmit the claim.

If not, the requirement is that you supply 3 comparables of properties in the area at 1.25 acres or less. If this is not possible, as you note, you will need to have an appraisal done of your own property at 1.25 acres to show that the additional acreage adds no extra value. Despite the letter provided, it will need to be an appraiser and not a realtor who provides this information. If the appraisal shows no additional value, the claim can be processed as submitted. If there is additional value, the reimbursement will be capped at the value of 1.25 acres.

As a trusted military Realtor in Ottawa we will work with BGRS to provide the letters and comparable properties they need in order to pay out the refund. This year we successfully defended 2 properties. In one case we had to go through the process a few times to get the exception. There is no guarantee. This is something that BGRS is getting more strict about and is something that military buyers in Ottawa should be very aware of.